DUBAI, UAE, Jan. 24, 2025: Bybit, recognized as the second-largest cryptocurrency exchange by trading volume, has unveiled its latest weekly crypto derivatives report. This report, created in partnership with Block Scholes, highlights the cautious optimism in the crypto markets following the unexpected twists surrounding Trump’s presidential inauguration.

The 2025 inauguration weekend was marked by a flurry of speculative activity as Trump-family-themed meme coins, TRUMP and MELANIA, gained traction, pushing derivative markets toward a bullish outlook. However, the much-anticipated executive orders tied to BTC failed to materialize, dampening market enthusiasm. Implied volatility saw a decline, even as realized volatility climbed. Meanwhile, perpetual and options markets maintained elevated funding rates and a lingering bullish sentiment, painting a picture of speculative complexities amid shifting political landscapes.

Key Highlights:

Solana’s Standout Moment:

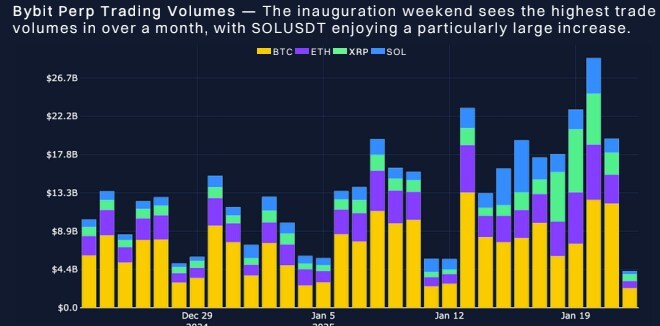

The launch of “husband and wife” meme coins by Trump on Solana’s decentralized exchanges sparked record-breaking activity in Solana’s perpetual swaps. Traders speculated on potential crypto-friendly policy announcements, which drove the network’s fee generation to unprecedented levels. This surge in activity positioned Solana as a leading competitor, overshadowing Ethereum in this symbolic moment.

Resilience in Derivatives Markets:

Despite the lack of crypto-positive announcements during the inauguration, perpetual swap funding rates remained predominantly neutral-to-bullish. Open interest showcased stability, signaling that derivatives markets viewed the event as one among many potential catalysts for future market movement.

BTC Options Activity:

Earlier speculation regarding a possible strategic BTC reserve led to a significant uptick in short-term options trading. Robust call buying and the strongest term structure inversion for at-the-money options since November 2024 highlighted this trend. Although front-end volatility has moderated since the event, there remains a strong skew toward out-of-the-money call options, indicating lingering bullish expectations.